Technology takeover

We examine the important technological advancements the industry needs to manage now and into the future.

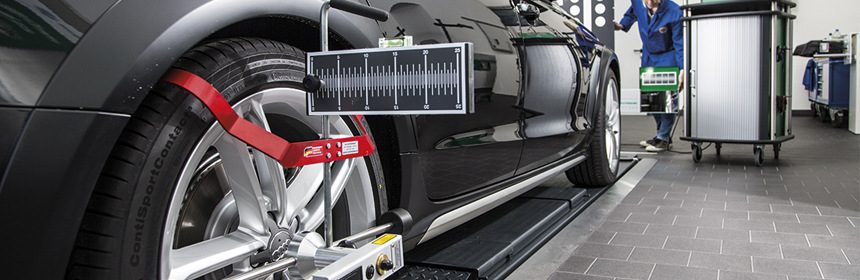

One area where technology is advancing within the bodyshop industry is in the development of a universal tool for the calibration of sensors for advanced driver assistance systems (ADAS). The number of ADAS that process information from cameras and radar systems is growing rapidly. Only a few years ago it would be unusual to see a car in the bodyshop loaded with this technology, but today it’s becoming commonplace.

As a result, bodyshops need to be able to calibrate the vehicle sensors, for instance after accident damage or the replacement of a windscreen. A diagnostic unit that simply communicates with the control unit in the vehicle is insufficient for this crucial work. Instead it needs to be combined with a device for the calibration of the sensors in the vehicle’s x,y and z axis. This calibration is critical to ensure that safety systems such as the auto emergency braking, lane departure and ‘intelligent lighting’ technology are correctly aligned.

Response

In response to this advancing vehicle technology the CSC-Tool (Camera & Sensor Calibration) has been launched. Developed by Hella Gutmann Solutions for workshops, bodyshops and glass specialists, the universal tool, designed with repair shops in mind, works in conjunction with the range of mega macs diagnostic tools from Hella Gutmann Solutions (HGS). The CSC-Tool ensures the correct positioning of the reference panel in relation to the vehicle’s axis. The mega macs diagnostic tool then communicates with the vehicle’s ECU to perform camera calibration.

Neil Hilton, head of garage equipment for HELLA’s diagnostics range explained, ‘Most garages and repair specialists consider such technology to be a thing of the future, but tomorrow’s technology is already here and vehicles equipped with ADAS are now being serviced by independent workshops and bodyshops.’

Beneficial

Another area of technology that is constantly evolving is online and mobile technology and, if used correctly, can be massively beneficial to the bodyshop industry as a business tool, helping to reach customers and engage with them beyond a single transaction.

Audatex, the global claims solutions providers, believes that insurers are not harnessing the power of apps and digital technology to their full capacity to boost customer engagement, beyond simply selling insurance cover. Paul Sykes, managing director of Audatex (UK) Ltd, explained, ‘The traditional approach misses the opportunity to extend the customer experience beyond the claims process. In reality, policyholders have assets to manage all year round, from buying and selling their current and other household vehicles, to servicing, maintaining and repairing these assets, all of which offer touch points for customer interaction.’

He continued, ‘Imagine how much loyalty could be built into the relationship if an insurer were to give additional support to motorists, helping them keep their cars legal, maintained and repaired, all year, rather than just during a claim.’

Social

And it’s not just processes that are and will be impacted. In less than a decade, social media has empowered businesses of all shapes and sizes, across a number of industries worldwide, to attract and engage with customers, and the wider industry. Today, 91% of Generation Y (those born between 1989 and 2000) will tweet about businesses or brands.

Paul said, ‘The social media relationship is one that by definition, has to work both ways, particularly as the new Generation Y has grown up with the internet. Technology is embedded into these people’s digital lifestyle to the degree that the first thing 72% of Generation Y do in the morning is check their smart phone and then on average another 110 times throughout the day. In fact, in 2014 mobile device time overtook TV screen time for the first time.’

It is this frequent engagement which offers businesses a big opportunity to connect with the customers of the future, and if we consider that by 2020 Generations Y and Z (those born after 2000) will account for well over 60% of individuals involved in motor accidents it is a ‘must do’. Paul said, ‘As an industry we need to change how we do things and how we engage and interact with these customers, not just now but in the future.’