New car sales fall again despite EV discounts

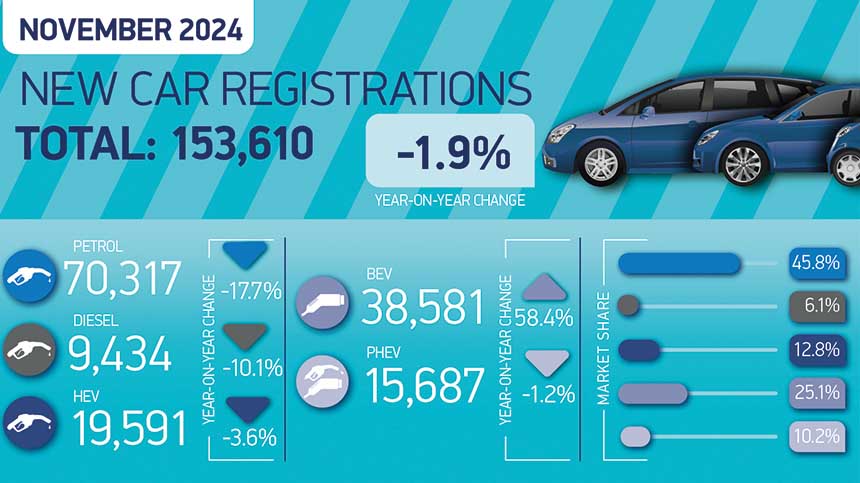

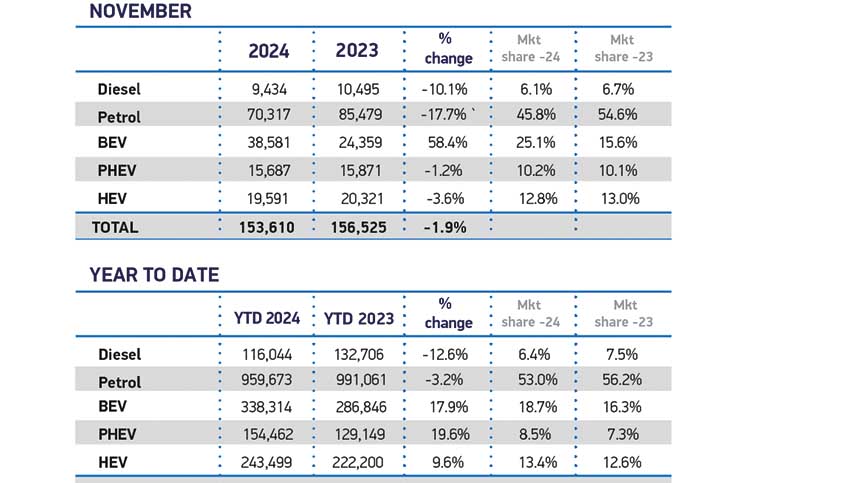

Deliveries of new cars fell by 1.9% in the UK during November with 153,610 joining the road, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

It is the second consecutive monthly decline, and the third decline in four months, as the market contracts amid the race to meet tough EV market share targets.

Demand from private buyers, among whom uptake has waned for two years, dropped by 3.3% to 58,496 units, accounting for fewer than four in 10 (38.1%) new registrations. Fleet purchases, which represent the bulk (59.9%) of the market, fell by 1.1% to 91,993 units, while low-volume business demand rose by 5.2% to 3,121 units.

November saw double-digit falls in registrations of petrol (17.7%) and diesel (10.1%) cars, with petrol remaining the most popular powertrain. Hybrid and plug-in hybrid uptake also declined, by 3.6% and 1.2% respectively.

Battery electric vehicle (BEV) registrations, meanwhile, rose for an 11th successive month, up 58.4% to 38,581 units, representing 25.1% of the overall market but driven by heavy manufacturer discounting. With the best market share since December 2022, November is just the second month this year in which BEV uptake has reached mandated levels, albeit against the backdrop of a declining overall market.

Manufacturers are committed to the mandate’s ambition, but market demand for EVs remains weak and below the levels expected when the regulation was drawn up by the previous government. The industry now expects the UK’s BEV market share to be 18.7% in 2024, although a strong December performance could raise that to 19% – still, however, short of the 22% mandated target for the year.

New car sales

This year’s growth cements Britain as Europe’s second biggest new BEV market by volume and closing the gap on leader Germany. It reflects long-term manufacturer investment in new models, with more than 130 zero emission choices now available – up more than 42% on a year ago – on which the sector is offering record discounts. While this is providing some success, the scale of discounting, worth some £4 billion across 2024, is unsustainable and poses a risk to future consumer choice and UK economic growth. With the right, responsive market regulation, however, the UK could hold a commanding position as an exemplar global market for a rapid zero emission transition.

Material consumer support from government, along with workable regulation, is essential – as is faster deployment of affordable, accessible and reliable charging infrastructure. According to the latest industry outlook, BEV registrations will need to grow by an additional 53% in 2025 if next year’s 28% mandated target is to be met – equivalent to 90,000 more businesses and consumers making the switch than the industry outlook expects.

Mike Hawes, SMMT chief executive, said:

“Manufacturers are investing at unprecedented levels to bring new zero emission models to market and spending billions on compelling offers. Such incentives are unsustainable – industry cannot deliver the UK’s world-leading ambitions alone. It is right, therefore, that government urgently reviews the market regulation and the support necessary to drive it, given EV registrations need to rise by over a half next year. Ambitious regulation, a bold plan for incentives and accelerated infrastructure rollout are essential for success, else UK jobs, investment and decarbonisation will be at further risk.”