Consolidation in the bodyshop sector is neither a new subject of discussion nor a new approach to the crash repair business, says ANDY WARREN, former head of supply chain, RSA.

I have witnessed numerous entries and exits over my 18 years in the motor repair industry. Insurers, vehicle manufacturers, dealer groups, daily rental companies and allied businesses have all had an attempt at entering the bodyshop sector. With, as we all know, varying degrees of success and some monumental displays of failure.

Nationwide Accident Repair Services’ (NARS) takeover of DWS, and of JCC last year, along with acquisitive businesses such as Gemini, prove consolidation is growing at an impressive rate. NARS, by buying their number two and three competitors, has really nailed the ‘national solution’ issue, while Gemini has already successfully exited and re-entered the UK market once before and is now mirroring this success in Australia. Its strategic national growth approach is one to watch as it spreads across the country.

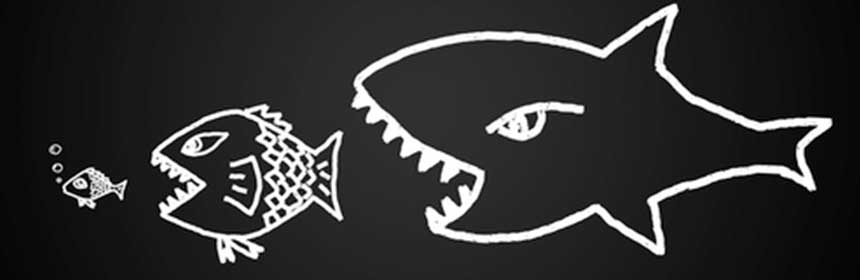

Consolidators and working groups standing out at the moment, such as Fix Auto and Vizion, also seem to be attracting the attention of the larger insurers. So is the future now a foregone conclusion that the industry’s big work partners are completely gravitating to the national groups and consolidators?

Common sense would indicate that, for insurers most definitely, engaging with the big guns gives you labour, parts and paint purchasing leverage, so surely this is an advantage? As is (undoubtedly), having single points of referral and management contact, central billing and engineering arrangements as well as that essential ‘trust’ factor. So do the independents need to run out and join national network groups or put up ‘For Sale’ signs, or even look to a new approach to attracting volume from different work providers?

Insurance companies are under huge pressure to compete and remain profitable in the aggregator led car insurance space. Claims are the biggest cost but insurer internal expenses are also an issue. Repairers have seen minimal price increase over many years now. Insurers are continually battling to bring expense ratios down and technology spend becomes more and more present in place of engineers, technically qualified repair staff, workflow management systems and, of course, all of the back office systems and software required to run a crash repair business. Keeping up with demands of customers is an expensive business, as is continually ticking the compliance boxes with PAS, environmental agencies and the various legislative bodies that the industry is aligned to. A clear picture has emerged that cost management for all participants in crash repair is the key component to survival, let alone profit and growth.

So how will the single site and privately owned entities survive? Clearly waiting for the industry giants to require capacity in their postcode is far too risky!

I am pleased to reassure them that there will always be a need for independent, nimble and well run bodyshops that provide a great local service. That is not to say that it will be easy but that’s hardly front page news. Attracting the insurance giants as an independent has always been and will continue to be a challenge.

Being a part of a qualitative working network collective, who will charge for work direction of course, will keep the productive workforce busy but may well restrict profit due to the referral costs. While we wait for some form of control and normalisation across the insurance industry to manage the numerous insurer ‘subrogation models,’ (don’t hold your breath), accident management companies will remain as strong work providers but that said, consumers still have choice in where they have their vehicles repaired. They may just not know it. Attracting the end-user (policyholder) customer, rather than the insurance customer, is far less expensive but equally as difficult.

Giving your local bodyshop business awareness in the community is becoming more and more essential. The recent Facebook and Twitter rants about buying your meat from a butcher, bread from a baker and fruit and veg from a greengrocer to support local businesses has, to their own admission, given Tesco and Sainsbury’s bloodied noses. Is this a consumer preference move? If it is, big may not be so beautiful and the whip hand may not remain with the giants permanently, and by giants that goes for insurers as well as accident management businesses and repairers alike.

My interaction with successful independents recently has proven that simple and low-cost promotions such as sponsorship of local youth sports teams, community-based advertising, promotions in colleges, training and community centres, canvassing small and medium sized local businesses, offers in local papers for low-cost valeting, MOTs, tyres and servicing etc has paid dividends in attracting crash repair work when it is required. It is all about the awareness. There are no referral costs, no payable commissions or rebates when business is won this way and, at the end of the day the bodyshop will invariably be billing a previously-negotiated price by an engineer to an insurer anyway.

The answer to all of the independent bodyshops problems? Of course not, but it may well mean the difference between closing down, being unwillingly acquired or continuing profitably.