SUVs were Europe’s top sellers in 2015

Sports Utility Vehicles (SUVs) were the highest selling cars in Europe in 2015, which meant the sector is top for the first time.

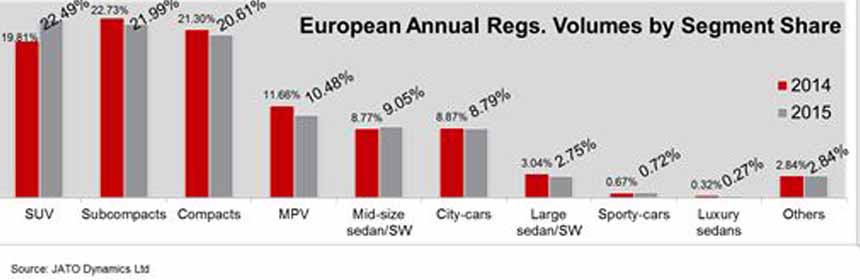

The boom in SUV sales saw European new car registrations increase by 9.3% in 2015. The sector saw an increase of 24% to 3.2 million units, which was a market share increase from 19.8% in 2014 to 22.5% in 2015.

Subcompacts were in second position with 22.0% share, while the compacts segment was third with 20.6%. These vehicles, along with the mid-size sedans/SW and sports cars, were the only segments to gain market share in 2015.

JATO Dynamics’ global automotive analyst Felipe Munoz said, ‘Similar to the shift towards SUVs in the US car market, Europeans are clearly favouring these vehicles. In 2015 this segment drove most of the growth as more consumers moved away from the traditional segments and MPVs, towards SUVs and crossovers.’

The SUV growth was partially helped by a large rise in sales of the small SUVs, which contributed almost 38% of total SUV segment registrations in 2015. 1.2 million were sold in 2015, which meant they exceeding the one million unit mark for the first time.

They were still behind the compact SUVs, which accounted for 40% of the total at 1.28 million units. Small SUVs growth rate was also outperformed by a 42% increase in mid-size SUVs, which totalled 470,400 units. Large SUVs came last with 243,000 units, up by 27% on 2014’s results.

SUV registrations grew in all of the 29 countries analysed, with the UK posting the highest volume increase from 501,200 units in 2014 to 630,400 in 2015. Portugal, Spain, Denmark, Croatia and Greece all posted more than 40% growth.

Subcompacts registrations totalled 3.12 million units, up by 5.8% over 2014’s volume. These cars were still the most popular in the Czech Republic, Denmark, France, Greece, Italy, Portugal, Romania, Serbia, Slovakia and Slovenia.

Although the Volkswagen Golf was the best-selling car in Europe, the compacts sector lost market share as its volume only grew by 5.8% compared to 2014. The limited growth was the effect of very low increases in Germany, France and the UK.

Through December, registrations of MPVs slid 1.8% becoming the top loser of the year. A sales rise in Germany and Spain wasn’t enough to offset the declining sales in the UK, Italy and France. Most of the fall came from the small MPVs whose volume slipped 11.5% compared to 2014.

Following the MPVs, the mid-size sedans/SW posted significant growth, outselling the city-cars, with 9.05% market share.